In all the noise surrounding the oil majors’ 2022 earnings announcements, one stat published by Greenpeace cut through everything: if you earned $49,000 a day from when Jesus was born, you would still not have made as much as Shell did in profits last year.

If 2022 will be remembered for anything other than the tragic war in Ukraine, it will be that in the face of a pernicious energy crisis, national governments were all too willing to row back on their climate commitments to satisfy short-term needs. As the flickering hope of limiting global warming to a safe-ish level of 1.5°C faded as a result, fossil fuel producers were showered in enough excessive profits to make Scrooge McDuck blush.

It is perhaps no surprise then that the idea of applying producer responsibility to the fossil fuel industry via a “carbon takeback obligation” is steadily gaining traction. The concept promises to guarantee net zero, force fossil fuel producers to pay for solutions and speed up the energy transition by making oil and gas more expensive.

Momentum behind the idea is gathering pace across Europe, with discussions under way in Norway, the Netherlands and the UK. In fact, in his recent ‘Mission Zero’ net-zero review, British Conservative MP Chris Skidmore asserted the UK government should “consider setting fossil fuel producers operating domestically a 10% storage obligation target to restore carbon dioxide to the geosphere by at least 2035, separate to any investment on nature-based solutions”. This pressure is only increasing as scientists, experts and former industry leaders push governments, most recently signing an open letter urging them to hold fossil fuel companies responsible for the required carbon clean-up.

Its proponents believe the carbon takeback obligation is a more effective and affordable solution than the current alternatives of slow-scaling carbon markets and blunt windfall taxes, and essential to reaching the Intergovernmental Panel on Climate Change’s (IPCC) target of ten gigatonnes of carbon dioxide removal per year by 2050. To put that figure into perspective, it is more than double the weight of all oil produced annually in recent years.

“The idea that governments are somehow going to pay for carbon dioxide disposal while the industry carries on making the money it is making, and being the size it is, is unrealistic,” says Myles Allen, professor of geosystem science at the University of Oxford and director of the Oxford Net Zero initiative. “So, we need an alternative.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“A carbon takeback obligation future-proofs your climate policy”

The war in Ukraine has refocused attention on the energy policy trilemma between affordability, environmental impact and security of supply – a trade-off that only becomes more acute the closer we get to the 2050 net-zero deadline.

Carbon pricing schemes such as the EU Emissions Trading System (EU ETS), and other non-price-driven demand reduction mechanisms, have identified cost-effective ways of reducing emissions, balancing affordability and environmental impact but can be thrown out of kilter by energy security concerns. Europe’s attempts to wean itself off Russian gas have led to short-term reversions to fossil fuels, particularly coal and LNG (some of it Russian).

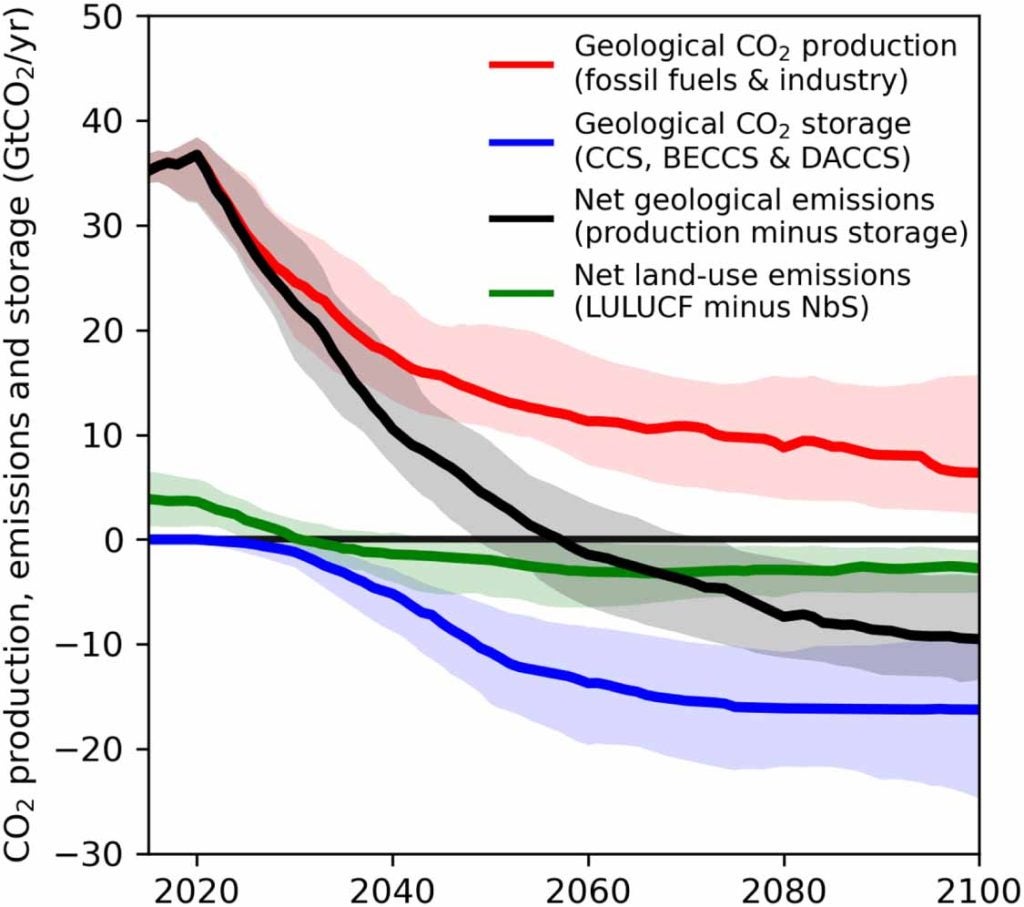

Models in line with 1.5°C of warming suggest the current restructuring of energy markets will still see the world using billions of tonnes of fossil fuels by 2050, producing around a quarter of the CO2 they do today. A massive upscaling of carbon capture and storage (CCS) technology is therefore required to reach net-zero emissions by that date.

To achieve that, a recent paper authored by a collective of renowned climate scientists, including Allen, argues that the existing notion of “extended producer responsibility” (EPR) could be applied to fossil fuel producers through a carbon takeback obligation. Under EPR, as implemented in France, for example, a “producer”, meaning “any natural or legal person who develops, manufactures, handles, treats, sells or imports waste-generating products”, “may be required… to provide or contribute to the prevention and management of the resulting waste”.

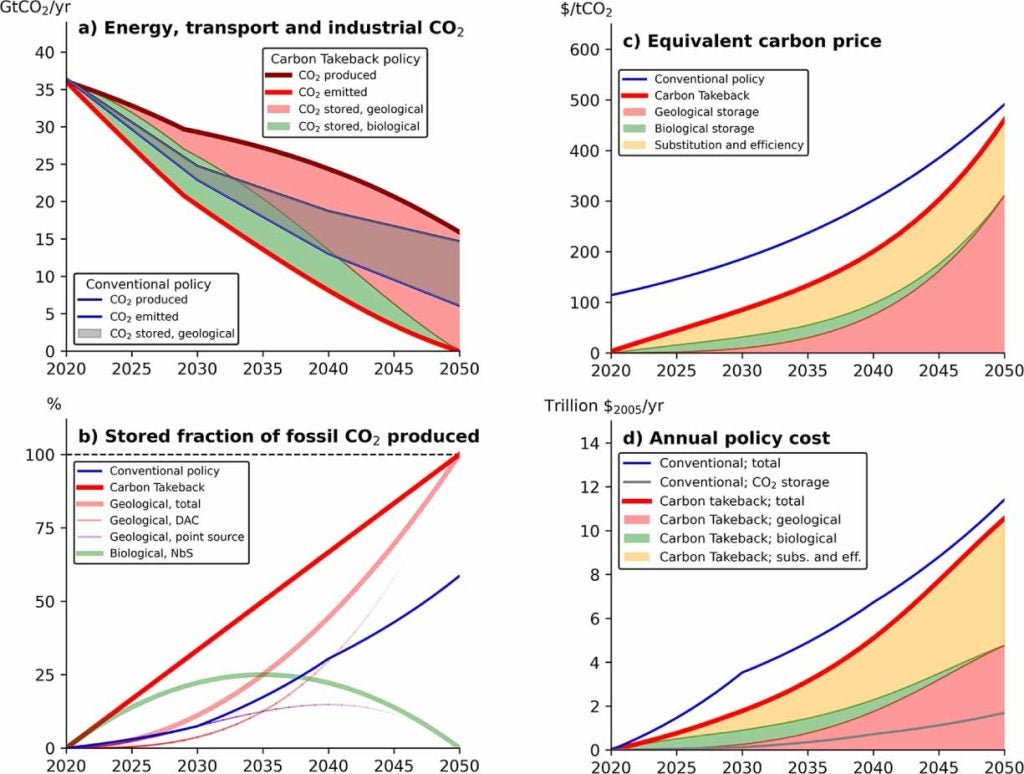

In practice, companies that extract or import fossil fuels would have to arrange for a percentage of the CO2 generated by those products to be permanently stored underground. That percentage would start off at around 1% and rise to 10% by 2030, adding just a few pence to the cost of a litre of petrol, suggest the scientists. It would eventually rise to 100% by 2050, thereby ensuring the transition to net zero. Carbon could initially be captured from other sources, such as cement plants or factories, and oil companies would not have to store the CO2 themselves either. The idea is that a market based on tradable “carbon storage units” (CSUs) would develop, to reduce costs. The carbon takeback obligation would be complementary to a moratorium on unabated fossil fuel use by introducing the concept of ‘safe civilian use’ of fossil fuels.

“A carbon takeback obligation future-proofs your climate policy, because if you are requiring the industry to get rid of the CO2, it doesn’t really matter what happens to the cost of renewables or fossil energy in the meantime, you will still get to net zero,” says Allen. “Whereas, if you are relying on a carbon tax, the fossil fuel industry has only to drop its prices and it will undermine the whole system. Or if you are relying on a cap-and-trade system, then a situation like the Ukraine war comes along and suddenly everybody is saying, ‘lift the cap because we are a bit short of gas at the moment’. So, a progressive ramp up of stored fraction is a much more predictable outcome.”

Another alternative is to apply a windfall tax on producers, with the proceeds spent on subsiding low-carbon development. However, that would disadvantage domestic oil and gas producers, increasing reliance on overseas producers and reducing energy security. Subsidies also provide less incentive to innovate and lower investment security than a simple licence-to-operate regulation. In addition, subsidising low-carbon energy without specifically requiring CO2 disposal does not stop fossil fuels from causing global warming unless complemented with a global ban on fossil fuel extraction – a geopolitically tricky proposition.

“A big disadvantage of the taxpayer paying for it is it doesn’t send a signal to the consumer or the producer,” says Hugh Helferty, a co-author of the carbon takeback obligation paper, and president of Producer Accountability for Carbon Emissions, a non-profit comprising former oil industry executives and energy experts. “A carbon takeback obligation sends a signal to the producer and the consumer that less production and less consumption would be better.”

According to the paper, even with conservative cost assumptions, a carbon takeback obligation delivers faster emissions reductions than relying on a global carbon price. It also does so at a lower cost, both per tonne of CO2 generated and because the investment certainty provided by the policy would result in much faster roll out of CO2 storage infrastructure.

The US state of California is considering a Carbon Dioxide Removal Market Development Act (SB 308) which, if passed, would make oil refiners responsible for taking back the CO2 resulting from their products, such as petrol and diesel. Under the proposed bill, this would be phased in by 2030 and would ramp up to 100% takeback by 2045. “California is one of the world’s biggest economies and has often taken a leadership position on environmental issues – which have then been picked up by other parts of the US and the world,” says Helferty.

“A complementary policy”

A carbon takeback obligation policy would not be without its drawbacks, however. The proposed use of large-scale CCS raises several concerns. Chiefly, investment in CCS technology is often criticised for its moral hazard by reducing incentives to limit fossil fuel use and making mitigation more costly. As with any climate policy, there are also questions on the willingness of governments to enforce it, and of consumers to accept higher fossil fuel prices. Finally, there is a risk that CO2 storage fails to materialise at sufficient scale and at reasonable cost.

Nevertheless, all 1.5°C-aligned mitigation scenarios rely on gigatonne-scale CCS – with a carbon takeback obligation being one of few policies to directly encourage investment in this area. Implementing ten gigatonnes of annual CO2 removal capacity would mean building CCS infrastructure to 25–50% of the scale of the oil and gas industry today. The carbon takeback obligation simply suggests leaning on the existing managerial and technical expertise of the fossil fuel industry to deliver that in time.

Ultimately, no single policy can address all concerns. The carbon takeback obligation is designed to stop continued CO2 emissions from the use of fossil fuels; it is not intended to replace existing energy efficiency and renewable energy policies. Demand reduction policies would still be vital to reduce demand for fossil fuels. The carbon takeback obligation would just serve as a backstop to catch residual CO2, which would otherwise be emitted.

“It is important to stress that this is a complementary policy,” says Allen. “So, in addition to all the policies we are implementing at the moment to drive down fossil fuel demand, this is a policy to drive up fossil CO2 storage. It is attacking the problem from the other side.”

“The idea that governments are somehow going to pay for carbon dioxide disposal while the industry carries on making the money it is making, and being the size it is, is unrealistic.”

Professor Myles Allen, director of the Oxford Net Zero initiative

So far, the fossil fuel industry has been frustratingly silent on the idea, neither expressing support for nor opposition to it, states Allen. “Life is pretty good for them right now, so why would they change anything?”

BP, Shell, ExxonMobil, Chevron, the International Association of Oil & Gas Producers and the International Petroleum Industry Environmental Conservation Association (IPIECA) all declined to comment when contacted by Energy Monitor.

However, in an IPIECA webinar on the subject in May last year, BP’s vice-president of CCS, Martin Towns, speaking on behalf of industry association the Oil and Gas Climate Initiative (OGCI), said: “The ideas [around a carbon takeback obligation] do have serious traction among the members of the OGCI. We are currently thinking about how we can support some of the underlying building blocks that would enable this as a useful policy mechanism to address climate change.”

“Some large oil and gas companies have started to do this on a voluntary basis, but we think that to drive significant action and large-scale uptake, it would need to be regulated,” he said. “CSUs could also be important enablers for carbon removals technologies like BECCS [bioenergy with carbon capture and storage] and DACCS [direct air capture with carbon storage].”

Towns laid out a case study of the UK as an example of the policy’s potential impact. The country could balance production with storage using a carbon takeback obligation with an increasing mandated storage fraction rising from 10% in 2030 to 25% in 2035, and 100% in 2050. Under the government’s forecast for oil and gas demand, this would result in a storage obligation of around 30 million tonnes per annum (mtpa) of CO2 by 2030 (aligned to the UK’s current CO2 storage target of 20–30mpta), rising to some 50mpta by 2035 and around 100mpta by 2050 (aligned to the independent UK Climate Change Committee’s recommendation).

More generally, a carbon takeback policy, Towns posits, would require standards for certifying storage, probably best drawn from existing rulebooks such as the IPCC, the Clean Development Mechanism and the International Organization for Standardization well as national laws and regulations. CSUs would be issued by central agencies, which would be able to verify storage under those defined protocols and use a registry for tracking them and cancelling them against obligations met as they are surrendered to balance fossil carbon supplied into a market. Governance would depend on the national and local target-setting approach.

“There could be an international club for this,” proposes Towns. “There could be lead countries that take up [carbon takeback obligations] first and then work together to partly internationalise that market – and that could grow over time under [the Paris Agreement’s] Article 6.2 mechanisms. A carbon takeback obligation allows more developed countries to be the purchasers of CSUs, allowing carbon to be stored in diverse locations.”

“The time is now”

Looking ahead, Allen, Helferty and other carbon takeback obligation flag-bearers are now trying to attain acknowledgement of the principle of “geological net zero”, the notion of putting one tonne of CO2 back underground for every tonne generated from a fossil source, into the United Nations Framework Convention on Climate Change’s process at COP28. “That is a short-term goal to get people to accept this as the destination we need to get to,” says Allen. “From there, they can work on what policy mechanisms to introduce to achieve that.”

The agenda could be sped along in the US if California’s carbon removal bill is adopted and copied by other states. “If the Democrats get re-elected in 2024, and can push something through Congress, this could happen in the US,” says Helferty.

In the EU, the European Commission recently proposed a Net-Zero Industry Act to scale up manufacturing of clean technologies. This act puts responsibility on major oil and gas companies to contribute toward CO2 storage, with a goal of geologically storing 50 million tonnes of CO2 a year by 2030 – a 66% increase on what is currently planned in the region. Oil and gas companies would be required to contribute to that goal based on the fuel they produce between 2020 and 2023.

Additionally, in the UK, a carbon takeback obligation proposal introduced by Baroness Worthington was meant to be discussed in the House of Lords on 28 March, only to be pulled at the 11th hour. Energy Monitor understands the proposal will be discussed by the UK’s CCUS Council first. The proposed amendment to the Parliamentary Energy Bill would only grant new licenses for fossil fuel exploration and extraction if producers captured and permanently stored a fraction of the emitted CO2.

Ultimately, the carbon takeback obligation and its attached notion of producer responsibility is a tangible and readily applicable policy intervention in a world of diminishing options. The world’s current climate action agenda is not sufficient to limit global warming to a manageable level. A recent report from the Systems Change Lab, a collaborative initiative convened by the World Resources Institute and Bezos Earth Fund, assessed progress across 40 key indicators of systems change – from phasing out coal to curbing deforestation – and found that not a single one was on track to reach its 2030 target. The window to limit warming to 1.5°C is rapidly closing.

“The time is now,” says Allen. “For heaven’s sake, the fossil fuel industry is making so much money at the moment that they could solve climate change without missing a beat. We have got to start talking about it.”