Flow Batteries Be the Key to Supercharging the Energy Transition

As a stifling heatwave spreads across Europe, solar panels all over the continent are busily transforming the scorching sunshine into electricity – particularly to meet the soaring demand for air conditioning. In fact, solar power met almost a quarter of all energy demand in five of Europe’s biggest power markets on 15 June, but it is times like these that also make power companies yearn for more utility-scale energy storage to bottle up all the extra renewable energy that could not be used at the time of generation, ready to be unleashed on gloomier days.

One such solution that is offering potential, the flow battery, may well be performing that service across southern Africa very soon. Austrian flow battery manufacturer CellCube last month signed a five-year framework agreement with renewable energy developer Kibo Energy to deploy at least 1GW of vanadium redox flow batteries (VRFBs) across the 16 Southern African Development Community countries.

Indeed, flow batteries are slowly but surely emerging from the shadow of their lithium-ion (Li-ion) cousins and could well be the more appropriate longer-duration storage solution to supercharge the energy transition.

A long-duration solution

As renewable energy capacity has skyrocketed in recent years, how to store electricity has become as important a challenge as how to generate it. Power grids need to be able to match incoming electricity supply to demand in real time, or they experience shortages or overloads. There are various ways grid operators can do this, including sharing power across large regions via transmission lines and locally via distribution grids, controlling demand (such as providing financial incentives for people to charge their electric vehicles in non-peak hours), and storing energy. For the latter, batteries and pumped hydro energy storage (PHES) have become the options of choice.

As the world looks to wean itself off fossil fuels, around two-thirds of the electricity generation capacity added each year is now coming from wind and solar. However, due to their innate variability, these renewables require energy storage. For grids with small amounts of wind and solar, traditional coal, gas and hydro generators can effectively balance supply and demand, but as renewables’ share of the power mix increases – as is happening all over the world – the need for storage capacity grows.

PHES currently makes up 94% of installed global energy storage capacity. Batteries make up most of the remainder. They are rapidly falling in price and can compete with PHES for short-term storage (minutes to hours), but PHES has tended to be much cheaper for long-duration energy storage (overnight or multiple days). Both will be needed to meet the vastly expanding demand.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe batteries that charge our electronic devices or cars are not suitable for the large-scale energy storage needed to power whole communities, key emergency services and critical infrastructure for extended periods. Making the jump from small to large capacity batteries that could back up the national grid at peak demand has proven tricky.

“Lithium-ion batteries offer high power density in a compact size and have many uses, although concerns have arisen about their potential to cause fires,” writes Martin Atkins, professor of green chemistry, Queen's University Belfast. “One technology focused on meeting large power needs is the redox flow battery.”

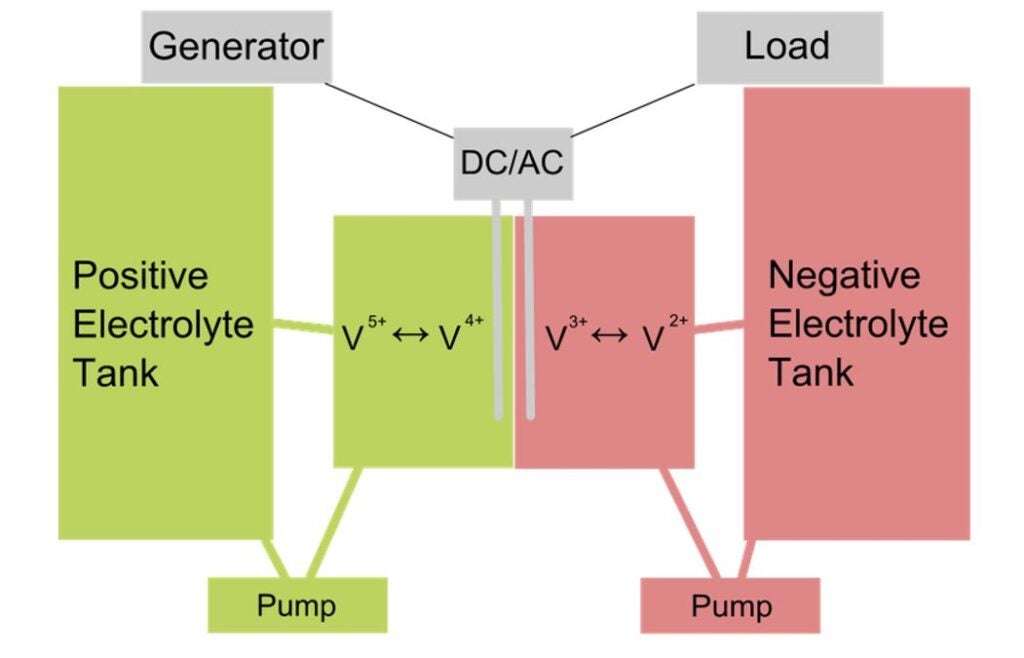

Like other batteries, a redox flow cell contains electrolyte solutions and a positive and negative terminal, around which electrons flow when the circuit is connected. If the battery is not charged, the electrolyte gradually loses its stored energy. How the redox flow battery differs is that in order to maintain energy, fresh electrolytes are continuously pumped into the battery.

“An important advantage of redox flow is that it is relatively low-cost… [they] are both practical and economical batteries,” says Atkins. The converter stays the same size for a given power density, but the duration of the power can be extended from four hours to more than 12 hours simply by installing larger plastic storage tanks to hold more electrolytes. The electrolytes’ charge can be regenerated through connection to electrical power to reverse the discharge process – “in other words, when mains power is connected, the tanks charge; when mains power fails, the tanks discharge as back-up”, says Atkins.

There are several types of flow battery – zinc bromide, polysulphides, zinc-cerium – but, for a number of environmental and cost considerations, vanadium-based batteries are now most common.

One drawback compared with Li-ion batteries is the energy density. “The size of the installation is large, although I see this as a positive way to differentiate those uses below 20MW [small Li-ion batteries] and larger installations of redox flow batteries providing 20MW or more,” says Atkins.

Research from industry trade group Vanitec found that advantages of VRFBs include their long lifespan and durability, low operating costs, non-flammable design and low environmental impact – both in manufacturing and operation. VRFBs have a higher capital cost than Li-ion batteries but can offer a lower cost of ownership and levelised cost of energy storage over their lifetime. “[VRFBs] can meet the needs of developers that require long-duration energy storage and can be operated with minimal maintenance for a 20-year lifespan,” found the study. “There is an over-reliance on lithium in the market today, but if VRFB manufacturing and deployment can scale up, continuous growth in the industry could be unlocked.”

[Keep up with Energy Monitor: Subscribe to our weekly newsletter]

The technology is also evolving. In an innovative take on the traditional flow battery, UK-based Swanbarton is developing an ‘organic’ redox flow battery for MSE International’s BluesStor project in Portsmouth, England. The system will be based on high-performance organic energy storage molecules. The material used, lignin, can be sourced as a by-product from pulp mills – it is non-flammable, non-explosive and can operate through more than 10,000 charging cycles.

The companies said the feasibility study showed the project's ability to procure energy for two visiting cruise ships at times of low demand. Due to the relatively low density of each battery cell, projects with a scale of up to 50MW or 600 megawatt-hours (MWh) could be built with the storage technology.

“We compared the levelised cost of energy (LCOE) for this battery against lithium-ion and vanadium redox flow batteries at four-hour, eight-hour and 16-hour durations. The LCOE for this eight-hour demonstration battery will be equivalent to a lithium battery, but the LCOE for a 16-hour battery will be 25% cheaper,” a spokesperson recently told pv magazine, noting that they expect the technology to outperform Li-ion at all durations above four hours by 2030. “The LCOE of this battery will outperform conventional VRFB at all durations,” they added.

Fast growth with teething issues

Demand for battery energy storage systems is set to take off in the coming years. The battery market was valued at $55bn in 2020 but is expected to grow at a compound annual growth rate (CAGR) of more than 13% by 2030, according to GlobalData, Energy Monitor’s parent company.

The VRFB industry is also poised for significant growth, equal to nearly 33 gigawatt-hours (GWh) a year of deployments by 2030, according to Vanitec.

There are several major projects that evidence a growing interest in flow batteries internationally. An 800MWh project in China by Rongke Power/UniEnergy is scheduled to come online this year and a 200MWh project in South Australia is in development by CellCube. The biggest VRFB installation in the world today is a 15MW/60MWh system brought online in northern Japan by maker Sumitomo Electric a few years ago.

Revenues from VRFB project deployments are expected to be worth approximately $850m this year and projected to rise to $7.76bn by 2031 – a CAGR of 41% in the market over this decade.

Regionally, Asia-Pacific leads the way for installations, with western Europe and North America the other top global regions. Asia-Pacific deployments are predicted to reach 14.5GWh annually, with western Europe hitting 9.3GWh and North America 5.8GWh, forecasts Vanitec.

The industry is not without its challenges, however. CellCube CEO Alexander Schoenfeldt recently told Energy-Storage.news the vanadium flow battery supply chain needs to scale up dramatically to reach gigafactory levels of production. “For today’s sales we are looking at the microgrid business rather than large-scale front-of-meter because the supply chain hasn’t ramped up yet for vanadium batteries,” he said.

“The vanadium battery supply chain… is peanuts compared to lithium. The big question is how we get our suppliers to ramp up and invest in larger machines and larger tools to move from a 30MW production capacity on an annual basis to a 300MW and then a 3GW annual capacity.”