Green hydrogen regulations proposed by the European Commission on 13 February offer crucial clarity to prospective US suppliers – and an incentive to start operating as quickly as possible. Project developers all over the world set their sights on European markets in early 2022 when the EU announced its ambition to import ten million tonnes of green hydrogen by 2030. They now have much more clarity on the product type that industrial consumers in Europe will be looking to deploy.

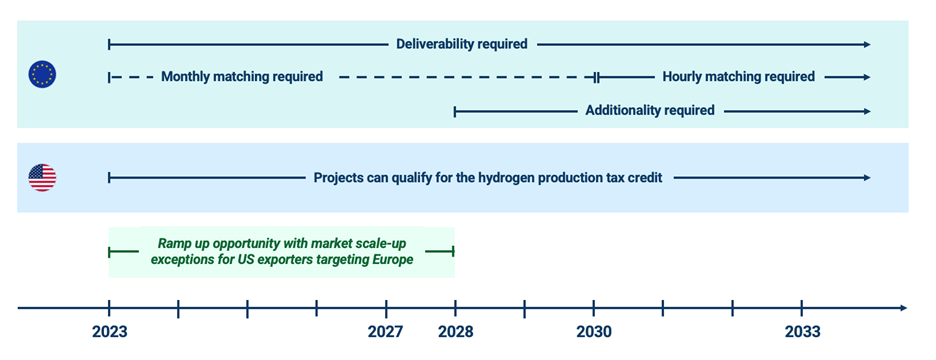

A key provision will determine which imported green products ultimately reach EU end users. The new regulations include a phase-in period to support immediate market development, during which producers are incentivised to scale up without having to comply with more stringent regulations. Critically, green hydrogen produced at sites operational before 2028 will be exempt from additionality requirements.

This means potential exporters that can launch their operations and deliver their first products to Europe within the next five years will not need to demonstrate that the renewables they use are newly commissioned, nor will they have to prove that their renewables have not received any public funding for their development. After 2028, newly operational sites will need to prove the renewables powering their production are “additional”, but already-active sites can continue operating without restrictions until 2038.

[Keep up with Energy Monitor: Subscribe to our weekly newsletter]

This is particularly significant for US green hydrogen producers targeting early EU offtake, as they are uniquely well-suited to deliver green fuel more quickly and cheaply than other early suppliers. The hydrogen production tax credit in the US will effectively reduce the cost of exported green hydrogen-derived commodities, but with generous provisions in the Inflation Reduction Act supporting new clean energy buildup, few hydrogen producers will build new renewables without taking advantage of state aid. Once post-2028 additionality restrictions are enacted in Europe, publicly subsidised renewables will prevent new US hydrogen from complying with EU standards.

Green hydrogen producers must act quickly

Hydrogen project developers that want to take advantage of US tax credits and still qualify their product for use within Europe will need to act quickly. Via its new regulations, the EU will structurally reward first movers who can supply its industries with alternative green fuels as fast as possible, but its rapidly decarbonising markets will not stay open to subsidised providers for long.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

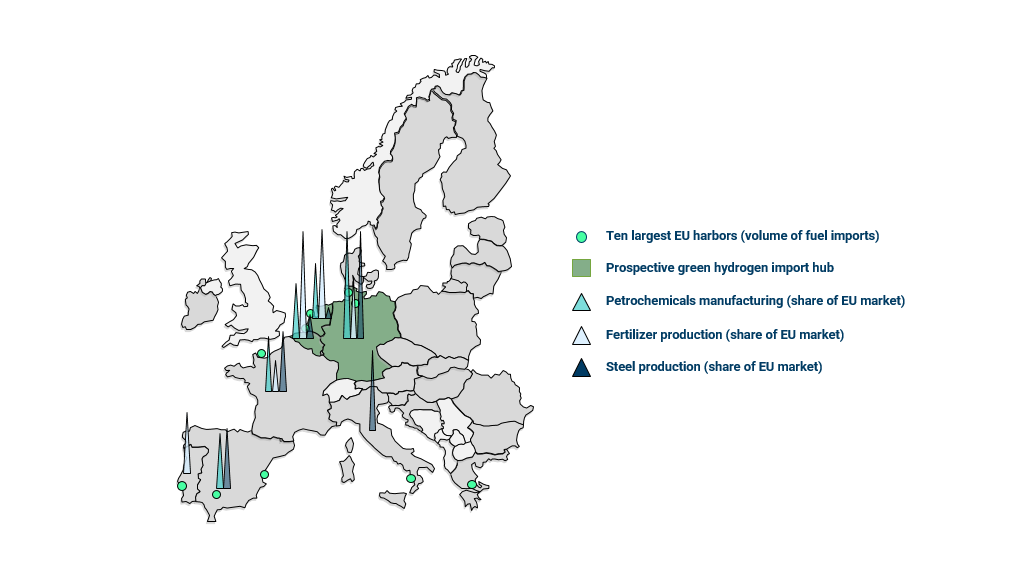

By GlobalDataThe EU’s proposed phase-in period postpones stricter hydrogen regulations for a few years, which can benefit first movers on both sides of the Atlantic. European heavy industries will be able to access nearer-term imports and expedite the transition away from fossil fuels while they are still facing sky-high gas, oil and electricity prices in the midst of an energy security crisis. Early green hydrogen imports can help the EU meet its increasingly ambitious renewable energy deployment targets and reduce reliance on Russian fossils fuels, while crucially decreasing short-term strain on domestic renewables that in turn can be used to enable rapid, continent-wide electrification.

In the US, green hydrogen producers can scale up their early operations by locking in contracts with ready-to-move end users in the EU, in addition to pursuing local offtake options. Policy support mechanisms in the US will effectively reduce the costs of green hydrogen commodities delivered to Europe, while mechanisms in the EU will incentivise fuel-switching in energy-intensive demand sectors.

US-EU hydrogen market symbiosis

Symbiotically, the US and EU can help grow each other’s hydrogen markets, adhering to a framework of hydrogen regulations that promote immediate large-scale project development while prioritising long-term emissions reduction.

Several immediate actions are still necessary to facilitate the buildup of green hydrogen trade routes into Europe. The EU must publish clear and specific guidelines describing how imports will qualify as a green fuel, to promote policy certainty for international suppliers. Project developers in the US must secure contracts with EU off-takers and make final investment decisions on large projects as quickly as possible to ensure that they can deliver green hydrogen to Europe in the near future.

The adoption of green hydrogen regulations proposed by the Commission is a crucial step to enable the EU to achieve its deployment ambitions – with a phase-in period that facilitates early green fuel deliveries from abroad, the bloc might reach its strategic hydrogen targets even sooner than foreseen.