Since Nasdaq acquired a majority stake in Puro.earth in 2021, the Finnish carbon removals marketplace, standard-setter and registry has seen a 500% increase in demand for its verified CORCs (CO2 Removal Certificates) – evidence of fast-rising demand for credible carbon removals as companies look to deliver on their net-zero ambitions. The world’s scientists now say carbon removal – reabsorbing CO2 already in the atmosphere – is essential to avoid dangerous climate change.

Puro.earth claims to have some of the most robust monitoring, reporting and verification processes in the industry. The company’s two-step verification is undertaken in partnership with third-party auditors and is of a rigour comparable to financial auditing. This aims to ensure that carbon removals are real and long-term so that buyers do not need to repurchase further down the line.

Energy Monitor caught up with Puro.earth CEO Antti Vihavainen and co-founder Elba Horta to find out just how the company goes about imposing order on this new Wild West.

How fast has the carbon removals market been growing and what is the outlook for the coming years?

Antti Vihavainen: Demand is outpacing supply, especially for the spot market, which is in a way the immediate delivery market. We have buyers that are willing to make an immediate purchase and get the CORCs delivered to their account to neutralise their residual emissions.

Over the past year, our cumulative order intake value has grown fivefold. That’s a tremendous growth trajectory, which is also reflected in the demand for future issuances. Companies are now more ready to make long-term offtake agreements. They are willing to accept they need to secure a future supply of carbon removals, and lock in the price and quantity.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThese [agreements] can take two forms. Either companies secure the certificates from existing [carbon removal] projects or they go for a project that has not been built yet, which is of course higher risk. For the latter, we have developed an instrument called the pre-CORC, which is a digital asset denoting the future issuance of a CORC. Those are probably the most effective way of expanding the carbon removal market. For example, Zurich Insurance has a long-term offtake agreement with some of our suppliers.

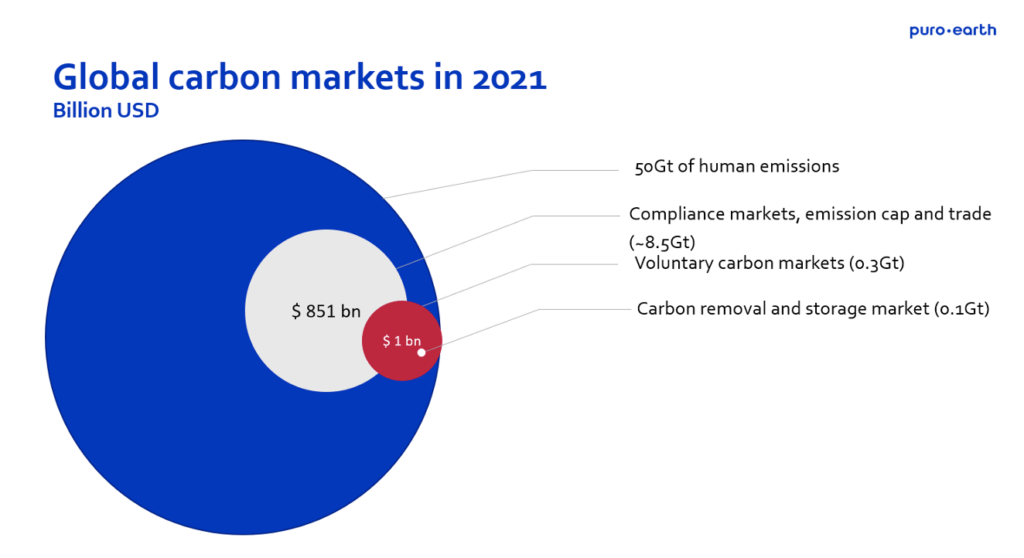

We are going to see carbon removals become the most significant portion of the carbon offsets market. Around 25% of global greenhouse gas emissions are covered by compliance markets [such as the EU Emissions Trading System (ETS)]. Even in Europe, only 45% of emissions are under the EU ETS. So, it's really quite a small portion. Then there are the voluntary carbon markets, and within that, the carbon removal and storage market.

We expect the compliance markets' coverage to grow from 25% to more than a third in the next ten years. The voluntary carbon markets are going to become a tool for the compliance markets, and it is likely that the carbon removal market will experience outsized growth.

Can you explain exactly how the Puro.earth marketplace works – and how you go about monitoring, reporting and verifying carbon removals?

Puro.earth co-founder Elba Horta: Although we have labelled ourselves a B2B marketplace for carbon removals, that’s just the tip of the iceberg. We've had to establish a lot of infrastructure. We’ve set up a registry so we know who owns what within the marketplace. We’ve established an issuing body that issues the certificates for the registry. But before they can do that, there needs to be third-party verification, and before the verifiers can do anything, they need to have methodologies to verify against. For the methodologies to exist, we had to establish an advisory board, so all of these are stacked on top of each other.

The suppliers of net-negative emissions can choose to sell through our marketplace, they can choose to sell directly to corporate buyers or they can use another marketplace. We are essentially a listing service. On our website you can see some of our suppliers and their prices. If they do not see a lot of demand, it's likely they will lower their price; if they see too much demand, it's likely they will raise it. Most of the deals are done bilaterally between buyer and supplier.

[Keep up with Energy Monitor: Subscribe to our weekly newsletter]

We had to create a carbon standard to be able to validate the carbon removals scientifically. That is overseen by an advisory board, the chairman of which is Oxford University’s Dr Myles Allen, who was the person to first talk about net zero and needing removals for it.

For the third-party verification, we create methodologies with the help of a working group of relevant scientists and carbon removal experts. The third-party verifiers then verify compliance to that methodology. When they have actually visited a facility and seen the evidence for a net-negative emission, a CORC can be issued per metric tonne of carbon removed. We issue the CORC to the company on our registry, which is publicly available for anybody to see.

On the marketplace, we list our sales and trading as well as all the resellers and brokers. The CORCs can be sold on other marketplaces too, not just our own.

How can you verify how long carbon will be stored for?

AV: Take biochar, for example; its chemical composition can be analysed in a laboratory. [Biochar involves burning biomass in an oxygen-limited environment to produce charcoal that resists decay and can be used as a soil additive]. There is actually 3,000 years of experience in creating biochar in places like the Amazonian basin, Scotland and Finland. We know that carbon resulting from the process is very stable. So we analyse the process in a lab and calculate the temperature of the soil, where it's deposited, and so on. That tells us how much CO2 will still be left in the soil after 100 years, for which we can then issue CORCs. If it’s a low-quality biochar in a very warm climate, then it's going to take more biochar to produce the same amount of CORCs – and vice versa. We use statistics to figure out how often the sites are likely to be disrupted and the carbon released into the atmosphere again.

How do carbon removal verifiers avoid the pitfalls of financial auditors and credit rating agencies, who have often been accused of providing positive certifications to companies that pay enough? Who will regulate this industry?

AV: There have certainly been enough challenges to the credibility of carbon markets in the past, but one of the most significant developments in recent times has been the establishment of the Taskforce on Scaling Voluntary Carbon Markets, which has now been renamed as the Integrity Council for Voluntary Carbon Markets (IC-VCM). The IC-VCM aims to establish something called ‘core carbon principles’, along with ways of making sure those are obeyed. That will help the whole industry a lot. It will make sure everyone is applying the same standards.

There has been a lot of focus in the press recently on low-quality or bogus carbon offsets and misleading corporate claims of climate or carbon neutrality. How do you ensure that greenwashing does not happen on your watch?

EH: We have five established methodologies [to verify carbon removals]. They have been validated by the advisory board and various stakeholders. It is pretty simple to determine whether a process falls into any one of them.

When it comes to developing new methodologies, which is ongoing, we initiate a working group of scientists, potential suppliers and other stakeholders. When we feel that the science is mature enough, we validate the approach.

At the moment, we are working on [developing a methodology for] enhanced weathering, which is a pretty straightforward process: you have a kind of mineral and you expose that to CO2 and water, and it turns the CO2 into a solid rock. There is sufficient understanding of how that process works, so it can be turned into a methodology – we think we will have completed it by the end of the year.

The cure cannot be worse than the disease. So we have to make sure we do not damage an ecosystem or put pressure on a local community when we remove carbon. All these things are debated heavily in the working groups. If there is a severe risk of unmanageable reversal [in other words, the CO2 getting back out into the atmosphere], we cannot establish a methodology for that process.

Additionally, the IC-VCM will provide guidance on what should and should not be scaled up as carbon removals processes. It suggests what needs to be taken into consideration when establishing new methodologies such as additionality and leakage.

Ours is a very conservative approach. All the quantification is done per project, not by averages as some others have done in the carbon standards space. We do our best, so that when our buyers make a carbon removals claim, they can sleep easy.

We are working with teams from Elon Musk’s $100m XPRIZE carbon removal competition. We are the official partner to help those teams get their wares into the carbon markets – but they have to provide evidence of the quality of their projects. We hope it will help us find new processes we can create methodologies for [so that they become a new source of carbon removals].