On opposite sides of the Atlantic, two big questions – arising out of wartime geopolitics, shifting economics and new climate policy – share a common answer.

The question in Europe is: how can the EU improve its energy security and slash climate pollution by weaning heavy industry off volatile fossil fuel imports including Russian gas? Across the Atlantic, policymakers and business leaders have a different question: how can the US take full advantage of its high-quality renewable energy resources, as well as new federal incentives that encourage clean energy development?

Transatlantic trade of US-made green hydrogen to the EU presents a compelling answer to both questions. Green hydrogen, made from renewable electricity, is the most promising replacement for fossil fuels in heavy industries that are difficult to fully electrify, such as steel-making and deep-sea shipping.

On the European side, importing green hydrogen instead of fossil fuels would help the EU meet emissions-reduction goals while bolstering energy security by shifting trade dependencies towards a trusted ally. On the US side, shipping green hydrogen-made fuels from Gulf Coast ports would create a robust export market for abundant Texas sun and wind power, while capitalising on new incentives in the Inflation Reduction Act (IRA) to produce green hydrogen.

Demand, meet supply

Developing an international market for green hydrogen makes sense because the EU and the US are already focusing public policy on different links in the green hydrogen value chain. The US is driving towards cheaper production at scale while the EU is stimulating the use of hydrogen to power heavy industry and transport.

In the EU, several recent policies and proposals are boosting demand for clean industrial operations. These include the ‘Fit for 55‘ plan that mandates economy-wide emissions reductions, a European Hydrogen Bank that will stimulate private investment in the hydrogen value chain, and carbon contracts for difference that compensate industrial players for investing in climate-friendly technologies and upgrades.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis policy environment, along with the long-standing existence of a cap-and-trade carbon market in Europe, means that EU industries have had years to map out their decarbonisation strategies. Consequently, many heavy industry and transport players in Europe are closer to “fuel-switching”.

However, Europe cannot cost-effectively produce the massive amounts of clean energy needed to fuel year-round industrial production. Although the EU is pursuing large-scale electrolyser projects to synthesise green hydrogen with renewable energy, the bloc acknowledges that domestically produced hydrogen will only cover half of projected EU demand in 2030. In its landmark REPowerEU policy, Europe set a target to match domestic supply with an equal amount of imported hydrogen.

Keep up with Energy Monitor: Subscribe to our weekly newsletterThe US Gulf Coast is shaping up to be an ideal partner in this. Major pieces of federal legislation including the IRA and the Bipartisan Infrastructure Law provide significant new incentives for producing green hydrogen.

For example, the IRA contains a generous tax credit of up to $3 per kilogram (/kg) of clean hydrogen generated, along with parallel tax credits that encourage the development of infrastructure for hydrogen production. An Investment Tax Credit incentivises the development of renewable energy projects, a Production Tax Credit incentivises the generation of renewable energy, and an Advanced Energy Project Credit incentivises the manufacture of electrolysers to turn that renewable energy into hydrogen. Combined with the world-class renewable resources and infrastructure in Texas and nearby states, those incentives make the Gulf Coast one of the lowest-cost green hydrogen production regions in the world.

The export of green hydrogen also benefits from the economic tailwinds of falling renewable energy costs. The cost of solar electricity has dropped by 89% and onshore wind costs have fallen by 69% since 2010. As a result, building electrolysers in renewables-rich regions like Texas has the potential to create a low-cost hydrogen supply – even after factoring in the costs of shipping it across the Atlantic in the form of derived fuels such as e-methanol or green ammonia (expected to range between $0.8 and $1.2/kg in 2030).

Green hydrogen trade: a win-win-win

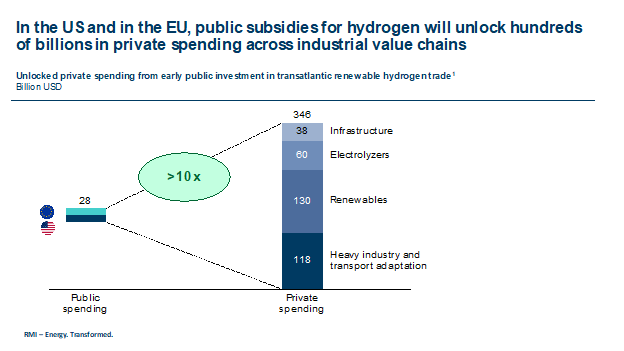

Public investments in developing the clean hydrogen trade – around $14bn each from the US and the EU, ramped up between now and 2030 – will catalyse more than ten-times as much private investment, according to our estimates. Industrial players in both regions will benefit from falling costs as the nascent green hydrogen ecosystem grows and begins to unlock economies of scale, and more competitive industries mean more jobs on both sides of the Atlantic.

The transatlantic trade in green hydrogen will make a perfect match of US suppliers and EU industrial consumers, but both sides face first-mover’s risk until that market is better established. Nonetheless, a few European companies are already moving on the opportunity, including Air Liquide, Iberdrola, Nel, Ørsted, RWE and Uniper. Connecting producers of low-cost green hydrogen to the industries most eager to use it makes good economic sense – and brings us one giant leap closer to a carbon-free future.

About the authors: Oleksiy Tatarenko is a principal in the Climate-Aligned Industries programme at clean energy non-profit RMI. Nabil Bennouna is a principal with the Climate-Aligned Industries programme at RMI focused on catalysing the clean hydrogen economy. Natalie Janzow is a manager in the Climate-Aligned Industries programme at RMI, where she focuses on the development and deployment of hydrogen policy internationally and in the US.