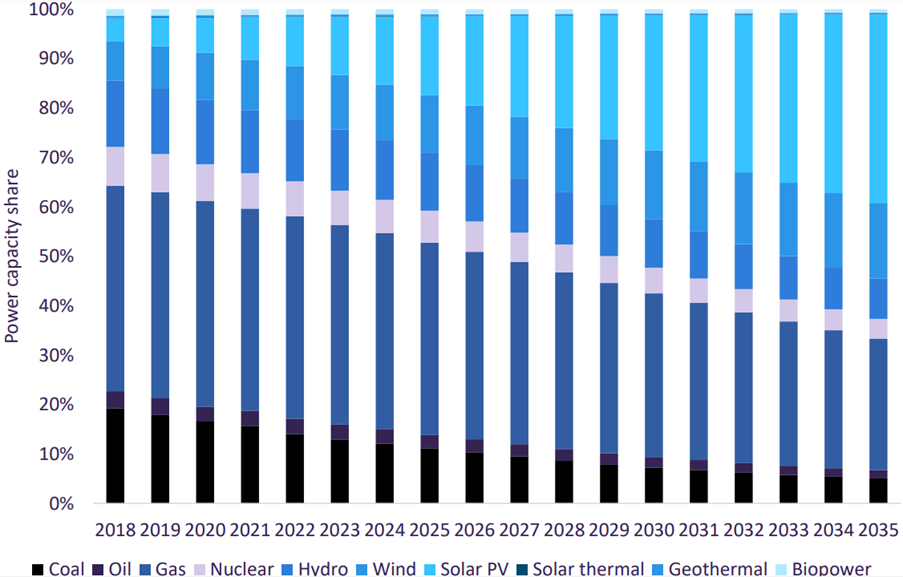

In an era defined by urgent climate imperatives and transformative technological advancements, unprecedented growth is projected in the renewable sector. GlobalData analysis suggests China will lead the surge in renewable capacity with annual additions of 57GW for wind and 150GW for solar photovoltaics (PV). The United States will expand its wind and solar PV generation with annual additions of 6GW and 35GW respectively. Power generation from wind and solar PV is projected to reach 2,476TWh and 2,090TWh over the course of 2024.

Declining technology costs, favorable policies and increasing energy prices are driving deployment of renewables. In addition to the environmental incentives, energy stakeholders are factoring in economic ones, with renewable energy sources helping to reduce energy costs and dependence on volatile international oil and gas markets. By 2035, it is anticipated that the historic dominance of oil and gas in the North American energy mix will have given way to a new era of solar and wind.

What does it mean for power plants? They face a dual challenge: phasing out more stable, but environmentally damaging, fossil fuels, while integrating intermittent renewable power. Handling this intermittency is a top priority, as Dr. Norbert Henkel, Director Power Plant Modernization at Siemens Energy points out. “Renewable energy sources like wind and solar have a variable power output that fluctuates based on weather conditions. Unlike traditional power plants, they lack inherent inertia and cannot readily adjust their output to maintain grid frequency, which can lead to sudden drops or surges, impacting the reliability of the grid.” Traditional grid stability will fade away. To compensate, the industry must bring new technologies and approaches, such as energy storage and grid modernization, to maintain reliability and efficiency.

Significant investment is necessary to realize the transition to a renewable-dominant energy landscape. The International Energy Agency estimates that, by 2040, an additional 80 million kilometers of transmission lines will be required globally – necessitating an annual investment of $60 billion. In some areas – Australia and Singapore, for example – policymakers are instituting new projects designed to map and combat grid instability associated with renewable energy. But these are exceptional cases – and power plant owners must act now.

Innovations driving change

The onward march of renewables mean grid stability has emerged as a critical challenge. Policymakers and power plants possess an arsenal of weapons they can wield to smooth the transition.

One option is adaptation of existing assets. Synchronous condensers are emerging as a vital solution to the challenges posed by the growth of renewable energy in the grid. These devices can slot into compatible power plants to provide inertia, short circuit and reactive power – making them especially beneficial in scenarios where traditional, inertia-providing generators are being phased out.

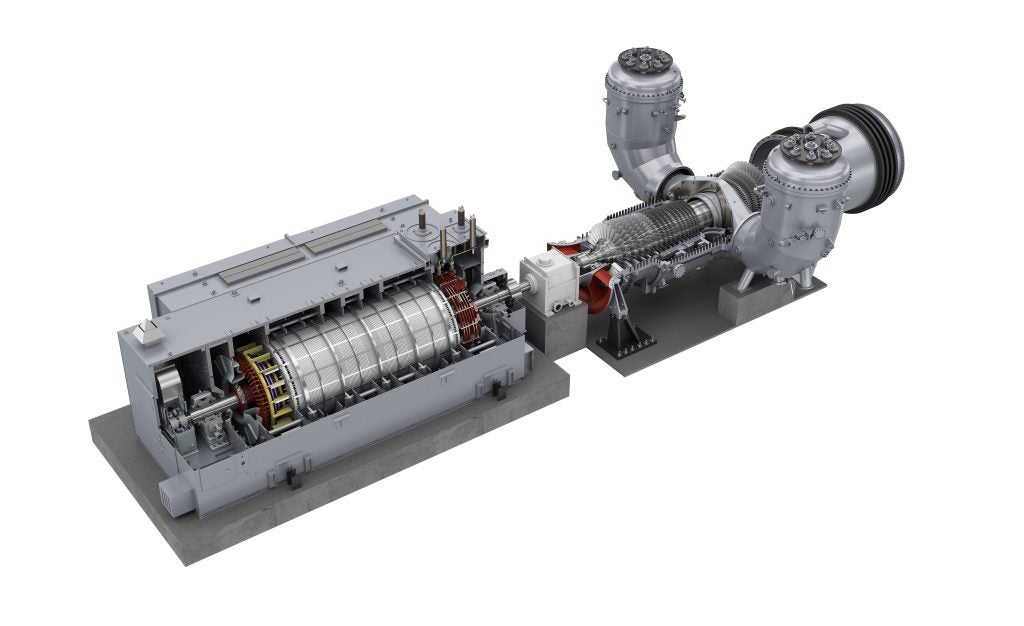

The conversion of retired steam turbine generators at Uniper’s Killingholme power station in the UK is one successful case study of synchronous condensers entering the grid via repurposing of existing equipment. Designed and installed by Siemens Energy, the project utilised Rotating Grid Stabilizer Conversion solution (RGS) with flywheels to enhance grid stability, providing 2574 megawatt-seconds (MW.s) of inertia. It demonstrated how retired assets can be revitalized to serve new and pivotal roles in the energy landscape.

An even more innovative approach involves the use of hybrid RGS, allowing existing gas turbines to seamlessly switch between power generation and grid stabilization modes. The first hybrid RGS solution – also a Siemens Energy innovation – will roll out in 2025 at the RATCH-Australia Townsville Power Station, Australia. Utilising a Synchro-Self-Shifting (SSS) clutch, this novel adaptation will allow the unit to switch modes instantaneously, providing up to 400 mega volt amps (MVA) of short-circuit power when operating as a synchronous condenser.

Dr. Norbert Henkel succinctly summarises the role they will play amid the ongoing energy transition: “The RGS Conversion can allow generators from retired power plants to support grid stability. In addition, our Hybrid RGS Conversion can expand the capabilities of operating gas turbines – transforming them into a dual operating system that can alternate between power generation and grid stabilization mode.”

Finally, battery storage. Wind and solar energy may be ample one hour and absent the next; battery energy storage systems are pivotal in managing this intermittency. In North America, the capacity of energy storage is anticipated to exceed 29GW by 2030, a compound annual growth rate (CAGR) of 23% from 2021. Lithium-ion batteries will dominate this growth, accounting for 97% of the storage capacity by the end of the decade. Globally, battery storage power generation capacity is set to reach approximately 126GWh by 2024, up from 93GWh in 2023. Major nations are rushing to corner the market; China is expected to dominate the sector with 38GWh in 2024, followed by South Korea with 22GWh and the US with 17GWh.

Where to start

From synchronous condensers to Synchro-Self-Shifting clutches, navigating the energy transition can feel complex for power plant owners. Many newer entrants will have banked on a fossil fuel future – only to find themselves grappling with the inexorable rise of renewables.

Working with an experienced partner, like Siemens Energy, can make things easy. As the pioneer of transforming existing power plants , they are playing a pivotal role for power plants navigating the transition from fossil fuels to renewable energy sources.

Siemens Energy provides comprehensive solutions for converting existing power plant equipment into synchronous condensers. They can enhance grid stability by providing necessary inertia, short-circuit power and reactive power compensation. And they do so by leveraging existing infrastructure – helping power plants to extend their operational life and contribute to the energy transition.

Siemens Energy’s RGS Conversion is distinguished by its versatility and includes a variety of methods. The basic RGS Conversion is swift and cost-effective. It involves decommissioning turbine components and removing the turbine connection, ideal for grid operators requiring a moderate increase in inertia and short-circuit capabilities. For grids requiring more substantial inertia, Siemens Energy can introduce flywheels with scalable and customized designs to the basic setup – significantly augmenting the inertia provided and enabling further increases depending on the flywheel size and design.

Significantly, Siemens Energy can readily implement RGS solutions on brownfield as well as greenfield sites. “Rotating Grid Stabilizers are cost-efficient solutions with a typical lifetime ranging from 30 to 40 years. Compared to greenfield projects, a brownfield conversion solution can cost considerably less,” says Dr. Norbert Henkel. “It can potentially save up to 50% in capital investment. It can also be implemented faster. Once an engineering study is completed, a simple conversion can potentially be completed within six months.”

With a proven track record in shoring up grid stability – exemplified by their role in conversions like the Killingholme power station – Siemens Energy are the experts in futureproofing power plants. Their advice? Be proactive. “Don’t wait for complete plant closure, and consider re-purposing before decommissioning to extend the life of your asset and contribute to grid stability during the energy transition,” advises Henkel. “Since the need for grid stability support is determined by grid operators and authorities, power plant owners should engage in an early discussion about whether their power plant is at the right location where additional inertia, short-circuit power, and reactive power compensation is required. They can then talk to solution providers like Siemens Energy to discuss the best option for the power plant.”

Siemens Energy are the seasoned experts in helping power plants manage the energy transition – and they are on hand to help you too. Download the whitepaper on this page to find out more.