Solar energy is supercharging the global clean power revolution and the latest news, and data highlight one thing – Germany is buying in.

As a source of electricity, solar power has experienced the fastest growth in its generation capacity compared to other technologies. Germany’s solar PV will see a compound annual growth rate (CAGR) of 25.7% from 2000 to 2035, more than double the 11.2% CAGR for wind, according to GlobalData forecasts. The rationale behind backing solar power is logical but does the far-right in Germany agree?

Solar PV’s popularity has been driven by technological development, which has resulted in low production and maintenance costs, arguably making it the most cost-effective and scalable energy source due to the modular nature of solar panels.

The state of Germany’s current power mix

Germany has capitalised on solar PV’s growth. According to GlobalData, in 2014, solar PV made up 20% of its power mix, with fossil fuels (coal, oil and gas) dominating at 43% and wind at 21%. In 2023, solar PV surpassed fossil fuels, accounting for 33% of power capacity compared to the latter’s 30% and 28% for wind. As of 2024, solar PV accounts for 38% compared to wind at 28% and fossil fuels at 26%, reflecting the sector’s steady growth and momentum gained over the past decade.

GlobalData’s contracts and tenders’ information corroborates this: in the past two years, 55 agreements—predominately power purchase agreements (PPA’s)—were signed within Germany. A notable rise compared to 15 projects a decade ago. In addition to their sheer number, the average scale and length of these agreements are increasing, with many contracts spanning decade-long periods. This can be seen with EDP Renewables signing a 20-year PPA with a large US-based tech firm to provide clean energy from 87MWp/58 MWac Ketzin solar project in Germany.

This increase in the average period of agreements highlights companies’ increasing long-term commitment to renewable energy, as some PPAs will supersede changes in leadership and corporate strategy, as companies make reducing scope 1 emissions and decreasing reliance on the volatile fossil fuel market central to their long-term aims.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

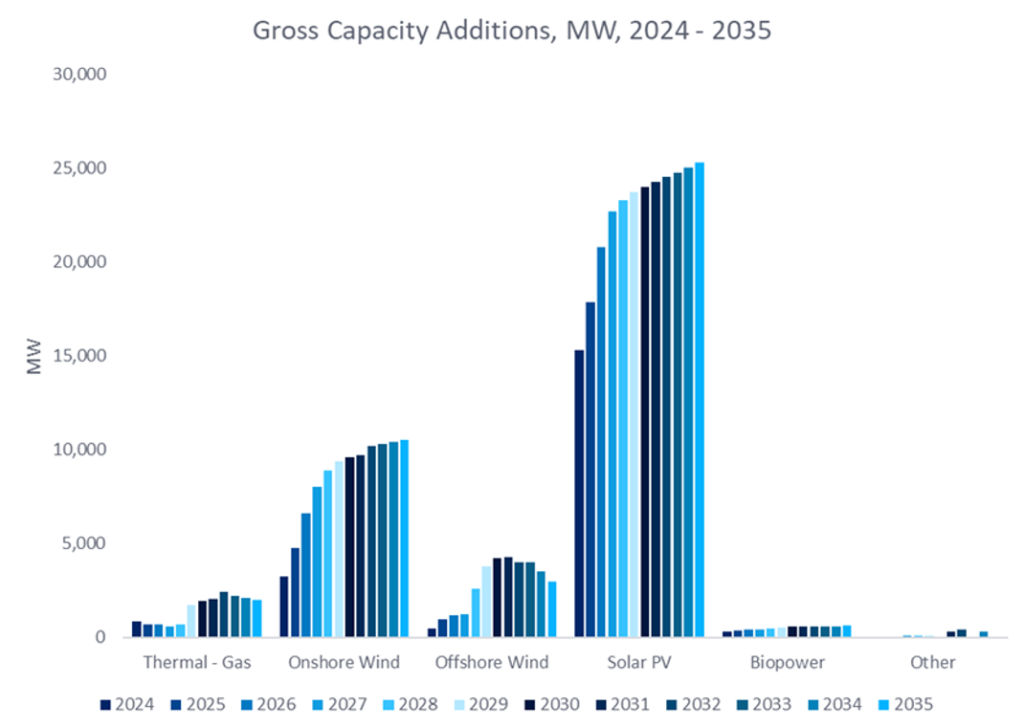

GlobalData’s power capacity forecast highlights the long-term importance Germany is placing on solar PV as the key to meeting its energy demand. This graph, which covers the period 2024-2035, shows that solar PV gross capacity additions will far outweigh any other alternative energy, notably in 2035, reaching 35 GW, more than double the next largest, onshore wind at 16 GW. Although this will be partially dampened by the loss of older solar infrastructure due to the 25–30-year lifespan of solar panels as well as solar repowering, this still represents an aggressive rate of installations.

How geopolitics is shaping the future of solar in Germany

The ramifications of Russia’s invasion of Ukraine are extensive, but in this context, it has reshaped the energy market in Germany. Since the conflict began in 2022, Russian fossil fuel exports to Germany have fallen significantly.

The German Government has since announced numerous legislations to accelerate the expansion of solar power as part of Germany’s goal to cover 80% of its energy needs from renewables by 2030 and achieve climate neutrality by 2045. The main law that supports solar energy in Germany is the Renewable Energy Sources Act (EEG). This came into effect in 2000, but the latest revision sets a solar PV target of 215 GW by 2030 and 400 GW by 2040.

So far Germany is on track having already met their target of installing 88GW of solar capacity by 2024, with its statistical office, Destatis, stating that as of April 2024, 3.4 million solar panel installations were linked to the grid. This represented 30% more installations and 20% more installed capacity over 2023. This hasn’t appeared to have slowed down competition for ground-mounted solar PV though, with Germany’s Federal Network Agency (BNetzA) announcing “the auction was almost twice oversubscribed”. In the end, 495 bids were made to the score of a volume total of 4,206MW, of which 268 won with a total volume of 2,152MW.

Germany is certainly not going into this solar revolution half-hearted, but could this strategy be a stroke of genius or prove divisive?

It is not all sunshine and rainbows

Germany’s investment and belief in renewable energy, particularly solar PV, is not without its challenges or opposition.

At its current rate of expansion, energy companies are concerned the current grid infrastructure will have an increasingly higher risk of grid instability if the growth remains unchecked. Maik Render, head of energy provider N-ERGIE has explained that “the solar panels installed in N-ERGIE’s area of operation at times produces twice as much electricity as is being demanded”. This creates a real risk of blackouts, a situation that will be more of a reality in southern Germany, where solar PV expansion has been well above the national average.

Renewable intermittency limits the grid’s ability to respond to supply and demand fluctuations. To counter this, the German economy ministry has made smart management systems a prerequisite for new and large PV installations. The only caveat is that this technology will take years to implement at scale while solar installations continue at a rapid pace to meet their renewable energy consumption target.

An anti-renewable mood is brewing, especially within Germany’s northern and eastern regions. Germany faces a €450bn bill in grid expansion costs, which will inevitably be passed down to consumers through their energy bills. Northern residents are already facing higher electricity prices because of the costs of connecting wind turbines to the grid, which is then distributed among fewer consumers due to low population density. A similar sentiment is felt in eastern Germany, where acceptance of renewable expansion is stalling, as prices are already 22% higher than the West.

The far-right party AfD won its first state election win in eastern Thuringia and came a close second in Saxony. Going into these elections the AfD were heavily leveraging the anti-renewable discourse, proposing tougher planning restrictions on constructing turbines, increasing the energy-storage requirements for renewable projects, and removing rules stating that set amounts of land are used for wind projects. Despite this success, mainstream parties have ruled out a coalition with AfD, but with its increasing vote share, it is now able to influence the discourse on renewables.

This could lead to a coalition between mainstream parties and the new nationalist-left party BSW. It seems either option is unwelcome news for the energy transition. Both oppose the current government’s climate and energy transition policy and agree to the resumption of energy trading with Russia.

Maintaining calm could be the key to stable expansion

Despite challenges, there are many positives regarding Germany’s energy transition and its forecasted solar PV growth. Given the nature of the length of contracts and investment being agreed, it would seem the country is settled in for its solar revolution, however, grid upgrades will be vital to ensuring consumers’ energy bills are not impacted too greatly. Otherwise, Germany risks becoming an increasingly green but politically divided state.