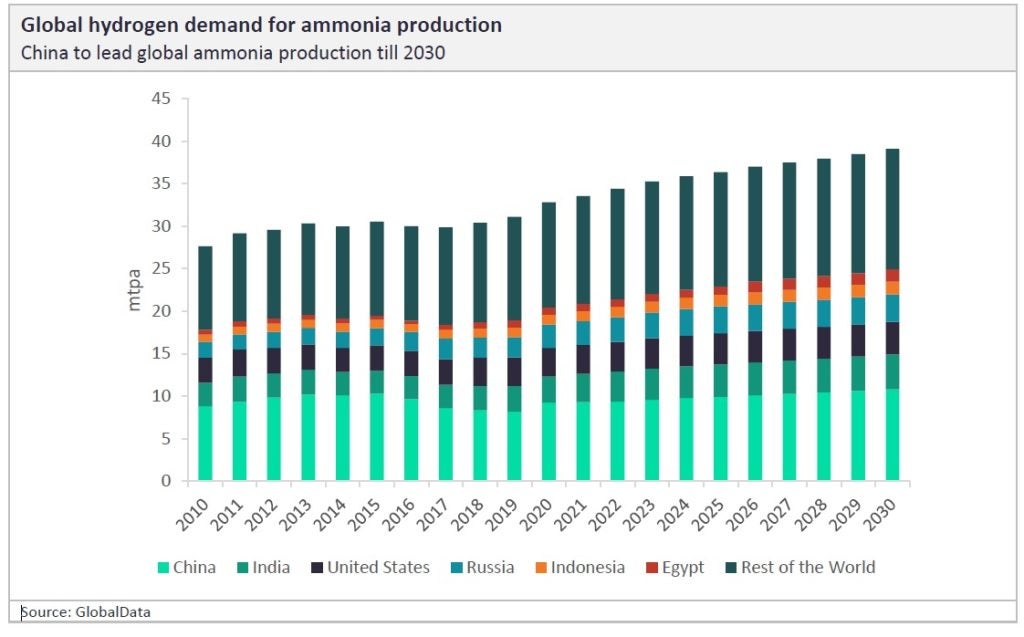

Existing ammonia markets are projected to increase by 20% to 2030. However, more than 70% of ammonia production today is made through steam reforming. This method of processing, which produces grey ammonia, entails large amounts of CO2 emissions.

Policy changes, government incentives, and the overarching pressures of the climate crisis has led to an increase in the demand for a greener ammonia, which can be achieved by producing renewable hydrogen before combining it with nitrogen.

As new markets emerge looking to utilise hydrogen, such as transport, shipping and power generation, the overall demand for ammonia is projected to increase 3–4-fold from 2020 levels in a 1.5 °C aligned scenario to 560–665 Mt per year by 2050.[1]

You can’t have one without the other

Around 40% of hydrogen produced globally is consumed in ammonia plants. The increased demand for ammonia as an alternative fuel, hydrogen carrier, and energy storage has driven the need for renewable hydrogen technologies to be deployed at scale.

According to GlobalData’s Hydrogen in Power thematic research: “The current carbon intensity of ammonia production is an obstacle, emitting 1.8 tonnes of carbon dioxide (TCO2) for each tonne of the chemical produced. Lowering this sector’s emissions can be addressed by investing in low-carbon ammonia technology, such as blue ammonia with Carbon Capture and Storage technology (CCS), or green ammonia powered by renewable sources.”

The production of low carbon ammonia uses a similar approach to the Haber-Bosch process for grey ammonia, which combines hydrogen and nitrogen. The difference lies in where the hydrogen comes from. When the CO2 emissions from the natural gas are captured, or if renewable hydrogen is used instead, the production of ammonia becomes lower carbon. According to the International Energy Agency (IEA), producing grey ammonia through traditional methods is nearly twice as emissions intensive as crude steel production and four times that of cement.

To produce renewable hydrogen, a technology known as an electrolyser is placed into the system, instead of using reformers which are commonly used to produce hydrogen from fossil fuels. The electrolyser unit, powered by renewable energy, splits purified water into hydrogen and oxygen, meaning only oxygen is the biproduct released into the atmosphere.

To create green ammonia, nitrogen, produced either through cryogenic or PSA oxygen units depending upon the scale of the facility, can be combined with the renewable hydrogen. The International Renewable Energy Agency’s (IRENA) scenario estimates that 83% of ammonia will be produced using renewable hydrogen by 2050. But why is this taking so long to adopt?

What is slowing down large-scale green ammonia production?

Green ammonia is currently two to three times more expensive to produce than traditional grey ammonia. To make green ammonia more competitive ramping up renewable hydrogen will be key, meaning there needs to be an increased investment in renewable energy sources, including wind and solar.

Cristiane Scaldaferri, Decarbonisation and Energy Transition Consultant at Advisian, says, “There will need to be substantial growth in the supply of zero-carbon electricity to deliver renewable hydrogen and therefore green ammonia on large-scale. Plans for power network developments need to anticipate the huge electricity demand required for producing renewable hydrogen via electrolysis.”

One challenge with this production is the vast amount of renewable energy required to power the electrolyser technology – around 55 kwh for 1kg of hydrogen. Electrolyser technology has been around for decades, but the high costs of renewable electricity means that renewable hydrogen is not cost competitive compared to traditional fossil-based hydrogen production.

According to Ralph Grob, Chemicals and Fuels Senior Consultant at Advisian, “Another challenge affecting scaling up the production of green ammonia is the fact you need tonnes of hydrogen, which means lots of electrolysers and pure water.”

“Getting the water purified to the level that you need to make hydrogen is going to be the limiting step in placing electrolysers in more arid areas of the world. Until electrolysers can use less pure water or salt water, we’re going to find that we can’t scale up green ammonia in the way that we thought or hoped we could do.”

How can these challenges be addressed?

To be on track with the Net Zero Emissions by 2050 Scenario, electrolysis capacity requires significant acceleration. Some countries are providing incentives for electrolyser manufacturers due to the amount of proposed large-scale renewable hydrogen projects.

Investing more into standardisation and innovation could significantly reduce hydrogen production costs compared to existing, largely customised, project delivery methods.

Worley is currently developing an accelerated package that includes a suite of products that creates a standardised and modularised asset solution. This product will be customisable for the desired scale and electrolyser technologies that their customers want to use in their renewable hydrogen projects.

There is also an increasing number of incentives to alleviate these costs, from regulatory support to subsidies and grants, carbon taxes, and research & development funding. For example, the EU has several regulations in place to support the development of a low-carbon economy, such as the Emissions Trading System (ETS scheme). This system limits greenhouse gas emissions from the energy sector and manufacturing industry. Some sector-specific free allowances are allocated, but if any production facility emits more than the allowance, then the shortfall must be bought annually from the EU ETS market. These free allowances will start being phased out from 2026 and disappear entirely by 2034, given the implementation of Carbon Border Adjustment Mechanism (CBAM).

“With schemes like this in place, traditional fossil-based (grey) hydrogen and grey ammonia plants will eventually be phased out over the next decade. This system will increase the production costs of high emitting processes and they will no longer be cost competitive,” Scaldaferri explains.

“We are seeing more and more governments create policies that are encouraging the use of renewable hydrogen and ammonia in industry – for instance, the Renewable Energy Directive II.”

Power the world

While small-scale production is plausible, this presents the issue of cost. Facilities do not want a premium on a final product that will be used for the same end-use as cheaper grey ammonia.

According to the IEA, around 70% of ammonia is used for fertilisers and global food security, while the remainder is used for various industrial applications. However, ammonia could be a clear pathway to decarbonise the transport sector. As one of the biggest emitters of carbon dioxide in the world, lower-carbon fuels are required to reach net zero.

“We expect to see a significant demand for both green and blue ammonia in the future as a potential long-haul shipping and trucking fuel. Yet more research and development are required to achieve this.” Scaldaferri explains.

“There is a call to possibly use ammonia as a hydrogen carrier because ammonia is easier and safer to transport,” Grob adds. “This way, you’re combining hydrogen with nitrogen so that you can ship it in trailers, trains, trucks, and other pipelines, and then crack the ammonia at the back end to make hydrogen again. Unfortunately, cracking is a very expensive way of doing it because you’re essentially making a product, converting to another product, and then making hydrogen again.

“There are a few ammonia cracking technologies that are commercially available at this time. The issue, however, is the economics of the solutions. We need to focus on sourcing the energy for the electrolysers to produce the hydrogen first.”

Playing a leading role in the transition

Today’s energy transition is unstoppable. The scale and pace of change needed is extraordinary, presenting unique challenges for the world’s biggest energy, chemicals, and resources businesses. With over 4,100 energy transition projects, Worley and Advisian are supporting customers on their journey towards delivering a more sustainable world.

Their experience includes more than 350 hydrogen projects around the globe, such as Shell’s Holland Hydrogen I project, which will be one of the largest commercial green hydrogen production facilities in the world once complete.

Other projects include a study for Queensland Nitrate’s commercial-scale production of renewable hydrogen to ammonia and Green Energy Oman’s (GEO) renewable hydrogen energy project which involves the production, storage, and export of green ammonia.

[1] Sustainability | Free Full-Text | Ammonia Production from Clean Hydrogen and the Implications for Global Natural Gas Demand (mdpi.com)