Awareness of environmental, social and governance (ESG) strategies is dropping as businesses increasingly opt to keep plans quiet in a move known as ‘greenhushing’, a recent GlobalData survey has found.

The Thematic Intelligence: ESG Sentiment Polls Q3 2023 survey, which was run across GlobalData’s network of B2B websites, looked at whether businesses had ESG strategies, the reason for setting them up and whether or not businesses are committed to ESG performance.

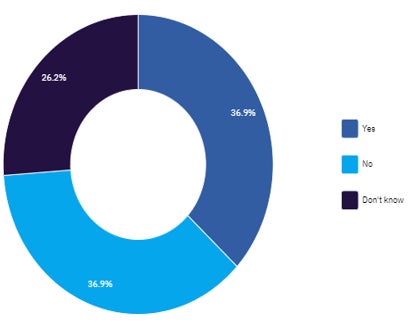

The survey found that only 37% of 363 poll respondents knew for sure that their company had an ESG strategy, a significant drop from the 51% recorded in the previous quarter.

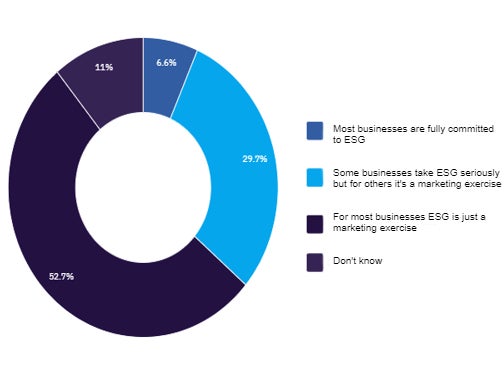

Companies are failing to communicate their strategies internally, and only 7% of 364 respondents believed most businesses were fully committed to ESG, down from 12% in the previous quarter.

This drop may be partly due to a recent spate of greenwashing scandals, which have prompted the new greenhushing phenomenon. Greenhushing is defined as being “where companies make less noise around ESG claims for fear of greenwashing accusations.”

The survey comes at a time of increasing scrutiny and new regulations to do with ESG. In September, the European Council and Parliament reached a provisional agreement to amend consumer rights laws in order to ban generic and unproven environmental claims, including ‘environmentally friendly’, ‘natural’, ‘biodegradable’, ‘climate neutral’ and ‘eco’. In the US, the Federal Trade Commission is also reviewing its Guides for the Use of Environmental Marketing Claims, which were last updated in 2012.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData’s survey analysis explains: “More formal regulation is likely across non-financial markets that will explicitly seek to define and prevent greenwashing. In March 2023 the EU proposed a Green Claims Directive, that would require any ESG-related advertising claims to be backed by an independent verifier.”

The push for regulation around greenwashing follows a series of scandals. Deutsche Bank’s asset manager DWS was recently found to have invested approximately $850m from its ‘green’ funds into fossil fuel companies, according to Finance NGO Finanzwende.

Goldman Sachs was also found to have fallen foul of proper ESG procedures, according to an SEC investigation. The company was charged for failures involving two mutual funds and one separately managed account strategy marketed as ESG investments, and paid a $4m penalty.

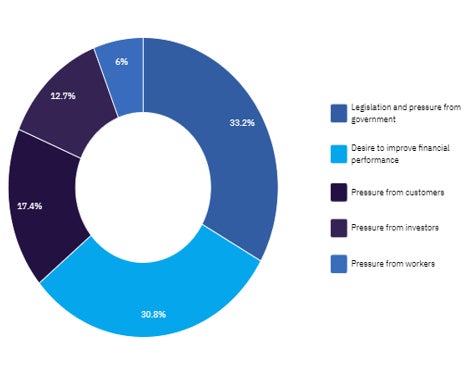

GlobalData’s survey found that 33% of 386 respondents said legislation and government pressure was the main reason for setting up an ESG performance plan in Q3 2023, making it the most popular reason overall. However, its share of responses was down seven percentage points compared with the previous quarter.

According to the survey results, the desire to improve financial performance was the second most important reason for building an ESG strategy. This correlates with the finding that 10% of respondents viewed ESG as the greatest threat to their business over the next year, an increase from 6% in Q2.

Meanwhile concerns over the impact of the Russian invasion of Ukraine on businesses fell to 23% from 30% in Q2, implying that concerns have shifted to new threats.