The power industry continues to be a hotbed of patent innovation. Activity is driven by land shortage, increasing wind power generation due to rapid urbanization, acceleration of sustainable and eco-friendly electricity source, flexibility for relocation, and the growing importance of technologies such as ballast-stabilized, tension-leg or mooring-line stabilized, and buoyancy-stabilized. In the last three years alone, there have been over 695,000 patents filed and granted in the power industry, according to GlobalData’s report on Environmental sustainability in power: floating platform wind turbines. Buy the report here.

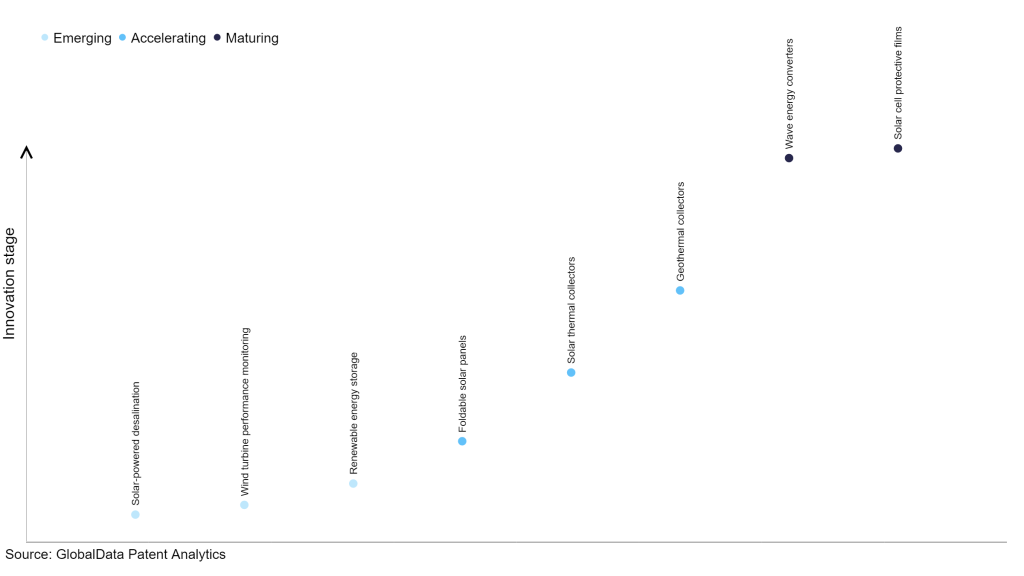

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

45+ innovations will shape the power industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the power industry using innovation intensity models built on over 83,000 patents, there are 45+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, solar-powered desalination, wind turbine performance monitoring, and renewable energy storage are disruptive technologies that are in the early stages of application and should be tracked closely. Foldable solar panels, solar thermal collectors, and geothermal collectors are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are wave energy converters and solar cell protective films, which are now well established in the industry.

Innovation S-curve for environmental sustainability in the power industry

Floating platform wind turbines is a key innovation area in environmental sustainability

A floating wind turbine is an offshore wind turbine which is installed on a floating structure in water body which generates electricity in water depths where fixed-foundation turbines are not viable.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 200+ companies, spanning technology vendors, established power companies, and up-and-coming start-ups engaged in the development and application of floating platform wind turbines.

Key players in floating platform wind turbines – a disruptive innovation in the power industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to floating platform wind turbines

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Repsol SA | 129 | Unlock Company Profile |

| Mitsubishi Heavy Industries Ltd | 74 | Unlock Company Profile |

| Naval Group | 59 | Unlock Company Profile |

| Siemens AG | 37 | Unlock Company Profile |

| Vestas Wind Systems AS | 34 | Unlock Company Profile |

| Xinjiang Goldwind Science & Technology Co Ltd | 32 | Unlock Company Profile |

| Hitachi Ltd | 28 | Unlock Company Profile |

| Aker Solutions ASA | 26 | Unlock Company Profile |

| Modec Limited | 26 | Unlock Company Profile |

| IFP Energies nouvelles | 20 | Unlock Company Profile |

| Mitsui E&S Holdings Co Ltd | 20 | Unlock Company Profile |

| Nippon Steel Corp | 20 | Unlock Company Profile |

| General Electric Co | 19 | Unlock Company Profile |

| Natural Power Concepts | 19 | Unlock Company Profile |

| Japan Marine United Corp | 19 | Unlock Company Profile |

| Aerodyn Engineering Gmbh | 18 | Unlock Company Profile |

| X Development LLC | 18 | Unlock Company Profile |

| NOV Inc | 17 | Unlock Company Profile |

| Xiangtan Electric Manufacturing Co Ltd | 16 | Unlock Company Profile |

| Dietswell SA | 16 | Unlock Company Profile |

| Single Buoy Moorings | 16 | Unlock Company Profile |

| Toda Corp | 16 | Unlock Company Profile |

| Esteyco SAP | 16 | Unlock Company Profile |

| Equinor ASA | 15 | Unlock Company Profile |

| Marine Power Systems Ltd | 14 | Unlock Company Profile |

| Nautilus Floating Solutions SL | 12 | Unlock Company Profile |

| DORIS Engineering | 12 | Unlock Company Profile |

| HD Hyundai Co Ltd | 12 | Unlock Company Profile |

| SeaTwirl AB | 12 | Unlock Company Profile |

| Hexicon AB | 11 | Unlock Company Profile |

| EnerOcean SL | 11 | Unlock Company Profile |

| Vinci SA | 11 | Unlock Company Profile |

| Makani Technologies LLC | 10 | Unlock Company Profile |

| Subsea 7 SA | 8 | Unlock Company Profile |

| Nakashima Propeller Co Ltd | 8 | Unlock Company Profile |

| Floating Windfarms Corporation | 8 | Unlock Company Profile |

| STRABAG SE | 7 | Unlock Company Profile |

| Axis Energy Projects Ltd | 7 | Unlock Company Profile |

| Pelagic Power AS | 7 | Unlock Company Profile |

| Milco SA Pty Ltd | 7 | Unlock Company Profile |

| Strabag Offshore Wind GmbH | 7 | Unlock Company Profile |

| TechnipFMC Plc | 6 | Unlock Company Profile |

| A.P. Moller - Maersk AS | 6 | Unlock Company Profile |

| Saipem SpA | 6 | Unlock Company Profile |

| Power Construction Corporation of China | 6 | Unlock Company Profile |

| Heerema International Group Services SA | 6 | Unlock Company Profile |

| RWE AG | 6 | Unlock Company Profile |

| Korea Electric Power Corp | 5 | Unlock Company Profile |

| ITI Scotland Ltd. | 5 | Unlock Company Profile |

| Esteyco Energia | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Repsol is the leading patent filer in floating wind turbines. Repsol and Ørsted signed an agreement to explore joint development of floating offshore wind projects in Spain. This alliance combines Repsol’s expertise as global multi-energy provider and Ørsted's experience as the global leader in offshore wind.

Some other key patent filers in the wind turbine industry include Mitsubishi Heavy Industries, Naval Group, and Vestas Wind Systems.

In terms of application diversity, A.P. Moller - Maersk leads the pack, while HD Hyundai and Aerodyn Engineering stood in the second and third positions, respectively. By means of geographic reach, Vinci holds the top position, followed by Stiesdal Offshore and Equinor.

To further understand the key themes and technologies disrupting the power industry, access GlobalData’s latest thematic research report on ESG (Environmental, Social, and Governance) in Power.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.