The oil & gas industry continues to be a hotbed of patent innovation. Activity is driven by innovations in new adsorbent materials, stringent environmental regulations, the need to reduce costs, and growing importance of technologies such as artificial intelligence, and machine learning. In the last three years alone, there have been over 327,000 patents filed and granted in the oil & gas industry, according to GlobalData’s report on Innovation in oil & gas: adsorption-based gas treatment. Buy the report here.

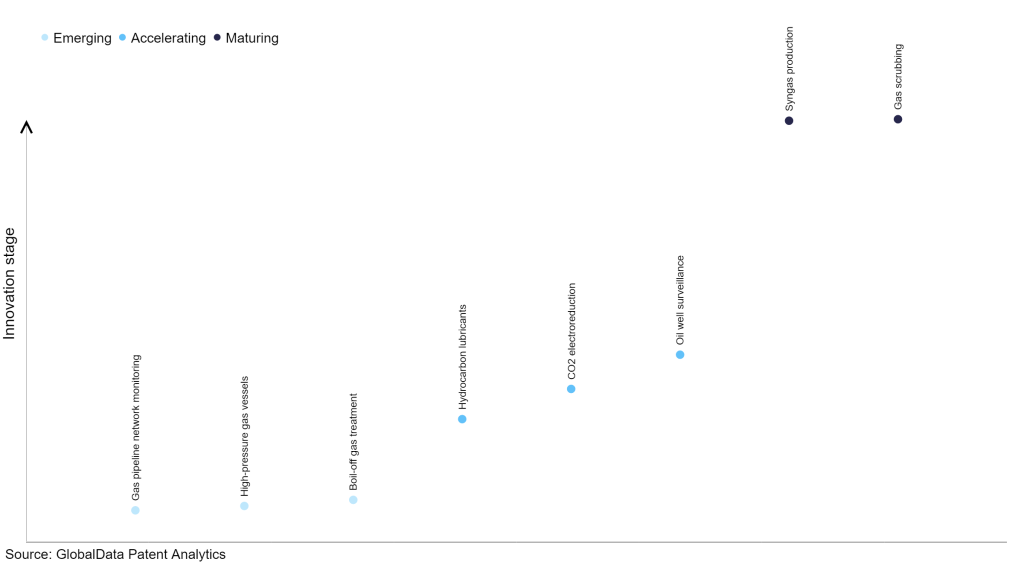

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

65+ innovations will shape the oil & gas industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the oil & gas industry using innovation intensity models built on over 201,000 patents, there are 65+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, gas pipeline network monitoring, high-pressure gas vessels, and boil-off gas treatment are disruptive technologies that are in the early stages of application and should be tracked closely. Hydrocarbon lubricants, CO2 electroreduction and oil well surveillance are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are syngas production and gas scrubbing, which are now well established in the industry.

Innovation S-curve for the oil & gas industry

Adsorption-based gas treatment is a key innovation area in oil & gas

Adsorption-based gas treatment involves using a gas separation membrane or adsorbent material to selectively remove certain gases from a gas mixture. The gas separation layer or adsorbent material selectively adsorbs the target gas based on its physical and chemical properties.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 225+ companies, spanning technology vendors, established oil & gas companies, and up-and-coming start-ups engaged in the development and application of adsorption-based gas treatment.

Key players in adsorption-based gas treatment – a disruptive innovation in the oil & gas industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to adsorption-based gas treatment

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Exxon Mobil | 726 | Unlock Company Profile |

| Air Liquide | 445 | Unlock Company Profile |

| Linde | 251 | Unlock Company Profile |

| Honeywell International | 194 | Unlock Company Profile |

| Dow | 166 | Unlock Company Profile |

| Shell | 163 | Unlock Company Profile |

| Air Products and Chemicals | 112 | Unlock Company Profile |

| RAG-Stiftung | 108 | Unlock Company Profile |

| Saudi Arabian Oil | 98 | Unlock Company Profile |

| Fujifilm | 98 | Unlock Company Profile |

| Halliburton | 61 | Unlock Company Profile |

| JGC | 49 | Unlock Company Profile |

| Chevron U. S. A. | 46 | Unlock Company Profile |

| Casale | 45 | Unlock Company Profile |

| Siemens | 41 | Unlock Company Profile |

| Sekisui Chemical | 36 | Unlock Company Profile |

| BASF | 36 | Unlock Company Profile |

| TotalEnergies | 35 | Unlock Company Profile |

| Energy Recovery | 32 | Unlock Company Profile |

| Sumitomo Chemical | 30 | Unlock Company Profile |

| Kuraray | 30 | Unlock Company Profile |

| IFP Energies nouvelles | 29 | Unlock Company Profile |

| Osaka Gas | 28 | Unlock Company Profile |

| Mitsubishi Heavy Industries | 28 | Unlock Company Profile |

| Waga Energy | 26 | Unlock Company Profile |

| Haldor Topsoe | 26 | Unlock Company Profile |

| Nissan Chemical | 26 | Unlock Company Profile |

| Mitsubishi Chemical Group | 25 | Unlock Company Profile |

| InvenTyS Thermal Technologies | 24 | Unlock Company Profile |

| ThermoChem Recovery International | 23 | Unlock Company Profile |

| Huntsman | 23 | Unlock Company Profile |

| Johnson Matthey | 22 | Unlock Company Profile |

| Evonik Industries | 22 | Unlock Company Profile |

| Schlumberger | 22 | Unlock Company Profile |

| LG | 22 | Unlock Company Profile |

| Hexcel | 18 | Unlock Company Profile |

| Toray Industries | 18 | Unlock Company Profile |

| JFE | 17 | Unlock Company Profile |

| Sumitomo Seika Chemicals | 17 | Unlock Company Profile |

| Petroliam Nasional | 17 | Unlock Company Profile |

| Renaissance Energy Investment | 16 | Unlock Company Profile |

| Commonwealth Scientific and Industrial Research Organisation | 16 | Unlock Company Profile |

| Apache Nitrogen Products | 16 | Unlock Company Profile |

| ThyssenKrupp | 15 | Unlock Company Profile |

| Saipem | 14 | Unlock Company Profile |

| Arkema | 14 | Unlock Company Profile |

| Axiom Angewandte Prozesstechnik GesMBH | 14 | Unlock Company Profile |

| JOHNSON, ROBERT A | 13 | Unlock Company Profile |

| Eco Technol | 13 | Unlock Company Profile |

| Chart Industries | 12 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Exxon Mobil is one of the leading patent filers in adsorption-based gas treatment. The company has robust and cost-effective technologies to remove impurities such as sulfur from natural gas. One such technology, OASE® sulfexx™, jointly developed with BASF, uses a solvent for selective H2S removal, while decreasing co-adsorption of CO2. The company also has other technologies, FLEXSORB™ SE and FLEXSORB™ SE Plus, for selective H2S removal in the presence of carbon dioxide using proprietary amines. Other key patent filers in adsorption-based gas treatment are Air Liquide and Linde.

In terms of application diversity Exxon Mobil leads the pack, while Air Liquide and ThermoChem Recovery International are in the second and third positions, respectively. By means of geographical reach, ThermoChem Recovery International held the top position, followed by and Huntsman and Schlumberger.

Companies are continuously innovating adsorption-based gas treatment to reduce emissions, lower operating costs, and increase efficiencies. Advances in this technology will further help companies to meet their sulfur removal targets and emissions regulations.

To further understand the key themes and technologies disrupting the oil & gas industry, access GlobalData’s latest thematic research report on Oil & Gas.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.