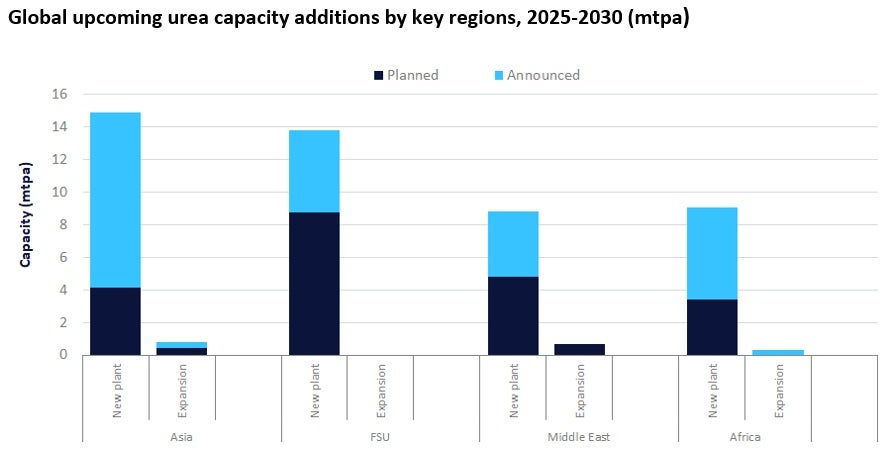

Asia is set to lead global urea capacity expansions by 2030, primarily driven by its vast agricultural sector’s demand for fertilisers and the use of urea in manufacturing urea-formaldehyde resins. The region is projected to increase its urea production capacity by 15.68 million tonnes per annum (mtpa) between 2025 and 2030, with India contributing the most at 9.46mtpa. Key projects in Asia include:

- Reliance Industries Jamnagar Urea Plant (India): Set to start in 2030, this announced project in Gujarat is in the approval stage and is expected to add 3.90mtpa in capacity. Reliance Industries owns the project entirely, with Reliance O2C operating it.

- Matix Fertilisers & Chemicals Panagarh Urea Plant 2 (India): Scheduled to commence in 2029, this plant is projected to produce 1.46mtpa.

- Brahmaputra Valley Fertilizer Corporation Namrup Urea Plant 3 (India): Also expected to begin operations in 2029, with an annual capacity of 1.27mtpa.

The former Soviet Union (FSU) follows next and is anticipated to witness considerable urea capacity additions of 13.79mtpa during the outlook period. The highest capacity addition in the region is expected from the ‘Nakhodka Fertilizer Plant Nakhodka Urea Plant’ in Primorsky Krai, Russia. This project is expected to commence production of urea in 2029 with a capacity of 3mtpa.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

By 2030, the Middle East and Africa are other key regions that are expected to add capacities of 9.46mtpa and 9.37mtpa, respectively. Iran and Egypt are central to the capacity additions in these two regions, in the same order. Further details of global urea capacity and capital expenditure analysis can be found in leading data and analytics company GlobalData’s new report, Urea Capacity and Capital Expenditure Outlook by Region, Countries, Companies, Projects and Forecasts to 2030.