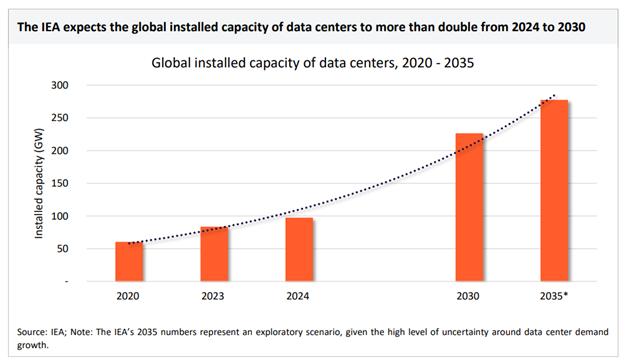

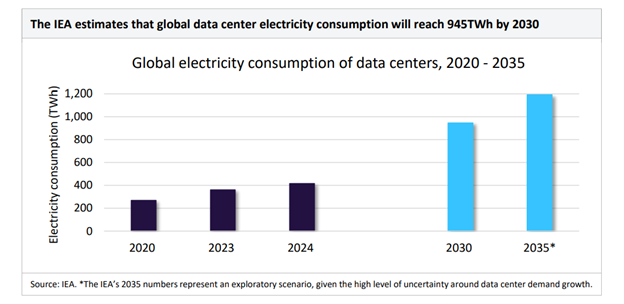

Few phenomena have come to dominate conversations around power capacity over recent years like the rise of data centres. They host cloud services, streaming, high-frequency trading and increasingly the compute-hungry workloads of artificial intelligence. That shift is driving unprecedented electricity demand concentrated in hyperscale facilities, putting pressure on grids, reshaping energy markets, and pushing utilities, developers and technology vendors to find ways to deliver reliable, affordable and increasingly low-carbon power.

The scale and character of the demand shock

A modern hyperscale data centre can draw tens to hundreds of megawatts continuously. Clusters of sites can reach gigawatt-scale demand in a region. AI training and inference workloads amplify consumption and can create sustained high-power draws rather than intermittent spikes. Data centre loads tend to be geographically concentrated (near fiber routes, cool climates or sites offering economic incentives), which concentrates grid stress and local environmental and permitting challenges.

Because data centre demand is highly reliable and relatively inelastic, grid operators must treat it as near-baseload demand. This changes capacity planning, increases the need for firm dispatchable generation and alters market dynamics for ancillary services and capacity payments.

Near-term responses: gas and flexibility

For utilities and system planners facing quick load growth, gas-fired generation remains the fastest route to dispatchable capacity. Combined cycle power plants offer efficiency and flexibility, capturing and reusing gas exhaust to provide highly effective, low emission and reliable power like never before. In many markets, new or upgraded dispatchable plants are contracted to support data centre connections or offered as part of bespoke utility service packages.

Expanding gas capacity brings trade-offs. Fuel price volatility, supply security concerns, and lifecycle greenhouse gas emissions contradict many corporate net-zero pledges. This tension is driving interest in turbine designs that can accommodate hydrogen blends today and higher shares later. Ensuring new thermal investments are “future-ready” is a central planning imperative.

The longer-term choices

But if data centres are here to stay, what are the sustainable power options on offer? For truly low-carbon, always-on power, nuclear – including small modular reactors – is a strong candidate. Nuclear aligns well with data centres’ continuous load profile, offering high-capacity factors and stable output. Small modular reactors promise lower upfront costs, modular construction, and siting flexibility closer to load centres, although regulatory approval and public acceptance will determine deployment speed.

Hydrogen and synthetic fuels (e-fuels) present an option to decarbonize thermal generation while leveraging existing grid and turbine infrastructures. Green hydrogen produced by electrolysis from renewables can be stored seasonally and burned in turbines or fuel cells. E-fuels (synthetic hydrocarbons made by combining green hydrogen with captured CO2) can be used in unmodified or lightly modified turbines.

The promise is substantial. Hydrogen enables low-carbon dispatchable power and a route to decarbonize industry and transport. The constraints are electrolysis costs, low-carbon electricity availability, hydrogen transport and storage infrastructure, as well as the need for turbines and fuel systems engineered for higher hydrogen fractions. Transitional strategies (blending hydrogen with natural gas and designing hydrogen-ready turbines) are pragmatic steps to avoid locking in unabated fossil assets.

Efficiency, waste-heat reuse and demand flexibility

Data centres are not passive loads. Advances in server efficiency, power electronics, and cooling technologies (particularly liquid cooling) can reduce electricity intensity per unit of compute. Crucially, waste heat recovery offers a way to improve system-level sustainability. In some European and Nordic projects, data centre heat is captured and fed into district heating networks or used for industrial processes, turning energy consumption into a local benefit and cutting net emissions.

On the demand side, not all compute is equally time-sensitive. Training jobs, backups and non-real-time analytics can be shifted to periods of surplus renewable generation. Time-of-use pricing, demand response arrangements, and tailored power purchase agreements with time-of-delivery clauses can incentivize flexible scheduling, helping balance grids while lowering costs for operators.

Integrated solutions and the role of major industrial players

Addressing the combined challenge of reliability, speed-to-market and decarbonization requires integrated, turnkey solutions. Zooming in on top players in the space demonstrates how these solutions can be effectively and efficiently implemented. Siemens Energy provides one useful example. Its portfolio spans gas and steam turbines, transformers and grid stabilization equipment, alongside software for plant control and grid digitization. Siemens Energy has been active in developing hydrogen-capable turbines, supporting CCUS readiness, and integrating renewables and storage components into hybrid power plants. For data centre customers, the company can supply not only the generation hardware but also the digital control systems and engineering expertise to design plants that meet strict availability requirements while allowing a transition to low-carbon fuels.

Beyond equipment, such companies can manage project delivery (from permitting and financing through construction and commissioning) reducing the complexity for both utilities and corporate data centre developers. Their R&D investments into hydrogen combustion, turbine materials, and digital twins help future-proof installations against changing regulations and decarbonization targets.

Practical examples and pilots

- Nordic waste-heat reuse: Several projects in Scandinavia capture data centre heat to supply district heating, improving local energy efficiency and strengthening social license for large facilities.

- Utility-data centre agreements in the US: Utilities have negotiated bespoke tariffs, behind-the-meter generation, and dedicated capacity arrangements to attract hyperscale customers while ensuring grid stability.

- Hydrogen pilot projects: Utilities and turbine manufacturers are testing hydrogen blends and retrofits at peaker sites and flexible plants to evaluate performance and emissions reductions under real-world conditions.

Policy and market design levers

Policy choices will influence outcomes. Essential outcomes are accelerating permitting for transmission and generation upgrades, setting standards for hydrogen readiness in new thermal plants, and creating revenue streams for long-duration storage and capacity services. Carbon pricing and procurement standards for corporate buyers (including data centre operators) can accelerate migration to low-carbon firm power.

Regulators should also encourage regional planning to avoid siting mismatches and ensure the local impacts of concentrated data centre development are managed – balancing economic benefits with community concerns and grid reliability.

The main risk is a lock-in to high-emission or stranded assets if short-term fixes are not aligned with long-term climate commitments. Conversely, the concentrated, high-quality demand from data centres is an opportunity to accelerate deployment of flexible, low-carbon firm power, if policymakers, grid operators, technology providers and data centre operators coordinate.

Keeping the data flowing

The data centre boom is a stress test and a stimulus for the energy sector. It forces a rethink of capacity planning, grid reinforcement, and the balance between short-term deliverability and long-term decarbonization. Solutions will be multidimensional: hydrogen-ready gas turbines and CCUS pathways; nuclear and small modular reactors where appropriate; long-duration storage; waste-heat reuse; and smarter, more flexible data centre operations.

Major players like Siemens Energy can play a pivotal role by supplying integrated, future-ready systems that reconcile reliability, cost and emissions goals. With coordinated policy, market innovation and technology deployment, the surge in data infrastructure can become a lever for cleaner, more resilient power systems rather than a driver of fossil dependence. To learn more about how Siemens Energy can power your firm’s transition towards a data-driven future, download the report on this page.